If you just want to start making saving money a habit or if you have a specific goal you’re trying to save for, you can use money saving challenges to help you kickstart your savings and stay motivated.

I’ll show you how to actually do a saving challenge, some tips on making saving challenges work for your specific financial situation, and I’ll also share 10 different saving challenges that you could try out yourself.

Why should you do a money saving challenge?

Since you’re here, you’re probably at least partially sold on the idea of doing a saving challenge, right?

But if you need more convincing, here are some great reasons to try out a saving challenge:

- They’re Fun – Yes you could just set up an automatic transfer from your checking account to your savings account, but there’s just something fun about manually doing that transfer and then checking off that you saved some money that week.

- They Keep You Motivated – Since all of these challenges have an end date, you can actually see yourself getting closer to the goal each week, and trying to keep your savings streak going can be good motivation.

- They’re Flexible – If the traditional saving challenge doesn’t quite work for you, you can just create a challenge that works for your specific budget/goal.

Struggling to Keep Track of Your Monthly Budget?

Our Ultimate Finance Planner Notion Template will keep you on top of everything from your bills to your budget and even how much you need to save to get that new bag!

I Need the Notion Template!

How to Make a Money Saving Challenge Work For You

Before we get into the actual challenges, let’s talk about how you can make a saving challenge work for you.

First, you should decide what saving method you’re going to use.

If you’re using a budgeting system like the Cash Envelope method, then you might decide that you want to save physical cash – so get some special envelopes ready.

If you do your banking digitally, maybe you should create a separate savings account specifically for this challenge.

CIT Bank has a great high-yield savings account that you can open online!

The next thing you should do is select a savings challenge that fits your goals.

Want to save a little over $1,000? Then go with the traditional savings challenge.

Want to save a lot more? Then try out the $5,000 or $10,000 saving challenge.

And lastly, don’t beat yourself up if you can’t save the entire amount each week.

It’s fine if something comes up and you need to adjust, but still try to save at least a little bit (even if it’s literally just $1) – you want saving money to become a HABIT.

**And here’s my bonus tip: if you get some extra money (like a bonus or cash gifts), there’s nothing stopping you from getting head on your saving challenge! 😉

Now on to the challenges!

The 52-Week Money Saving Challenge

This particular 52-week saving challenge is probably the most well-known saving challenge, so we’ll talk about this one first.

Here’s how it works: The first week you save $1, then the next week you save $2, the week after you save $3, and you just add a dollar to the amount you’re supposed to save each week, so by the time you get to week 52, you’ll be saving $50+ each week.

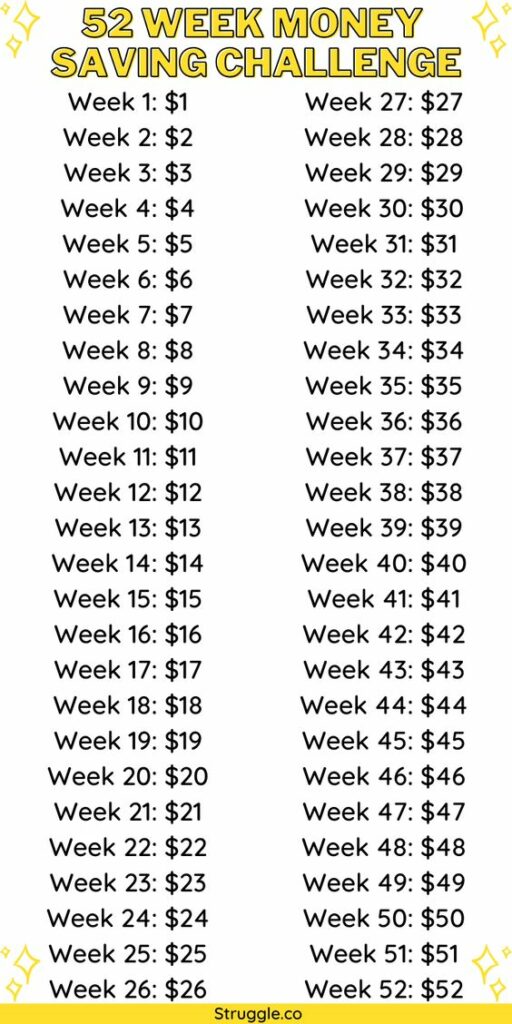

Here’s a chart so you can see what I’m talking about:

By the end of this saving challenge, you will have saved up $1,378 – which makes this challenge perfect for people who are trying to save up their starter emergency fund of $1,000.

Reverse 52-Week Money Saving Challenge

I got an issue with the traditional saving challenge… I don’t really like the fact that you’re saving the higher amounts towards the end.

For people who start this challenge at the beginning of the year, they will end up saving higher amounts when the holidays roll around – which sounds kinda tough, right?

So what do we do about this? Flip it and reverse it!

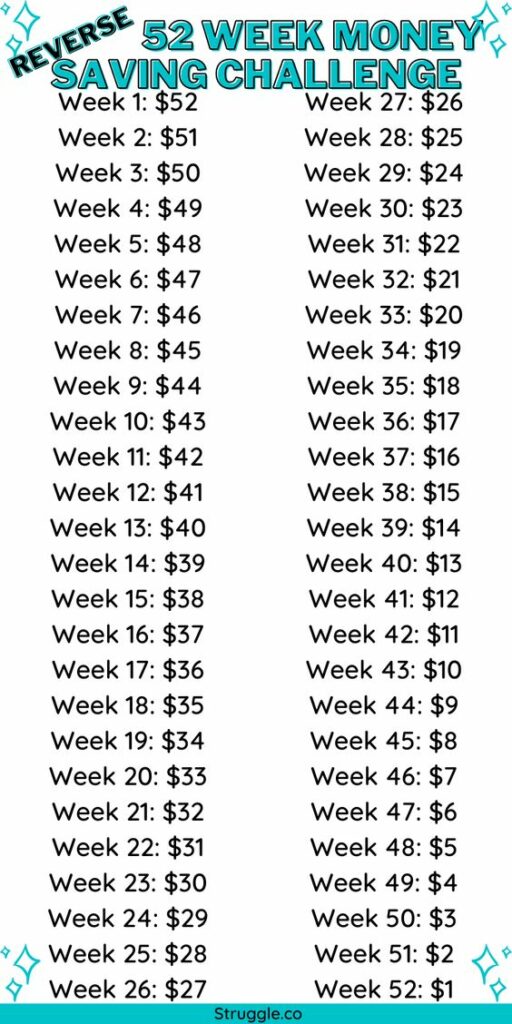

With the Reverse 52-Week Money Challenge, you will start by saving $52, then the next week you will save $51, the week after that you will save $50, and you just decrease the amount saved by $1 each week until you hit $1.

Don’t worry I brought another chart:

Double 52-Week Money Saving Challenge

If you have a saving goal that’s bigger than the $1,378 you’ll save using the traditional 52-week saving challenge, you can just DOUBLE the amount you save each week.

So week one you’d save $2, then the next week you’d save $4, and just add $2 each week.

By the end of the Double 52-Week Saving Challenge, you will have saved $2,756!

Other Year-Long Money Saving Challenges

Love the idea of doing a year-long savings challenge?

If you want to see some other money-saving challenges, here are four other challenges you can do in addition (or in place of) the traditional 52-week money-saving challenge:

Penny Saving Challenge

The penny-saving challenge is a great one if you don’t have a ton to save each week.

This is also a great challenge for kids!

To do the penny-saving challenge, you start by saving one penny, then add a penny to the amount saved each day.

By day 365, you will be saving $3.65! And after the challenge, you will have $667.95 saved up.

$5 Money Saving Challenge

This challenge is another great challenge for smaller budgets.

Here’s how it works: you save every $5 that you receive. This can be from gifts, from getting change, anything! Whenever you get a $5 bill you save it.

Most people do this challenge for one year, but you can do it for as long as you want (I’ve seen people do it for one month).

$5,000 Saving Challenge

Want to kick it up a notch and save $5,000 in one year?!

Then do this $5,000 52-week saving challenge!

You’ll start by saving $50 from Week 1 to Week 8, then from Week 9 to Week 20 you will save $75, from Week 21 to Week 36 you will save $100, from Week 37 to Week 48 you will save $125, and from Week 49 to Week 52 you will save $150!

$10,000 Saving Challenge

If you’re feeling incredibly ambitious and you want a huge challenge, try saving $10,000 in one year!

You’ll start by saving $100 from Week 1 to Week 8, then from Week 9 to Week 20 you will save $150, from Week 21 to Week 36 you will save $200, from Week 37 to Week 48 you will save $250, and from Week 49 to Week 52 you will save $300!

Other Money Saving Challenges

Here are some other challenges that will help you save money. These challenges are monthly challenges, so if you aren’t ready to commit to a year-long challenge, you could give one of these a try!

$5 A Day Saving Challenge

This smaller saving challenge is pretty simple: just save $5 every day for one month!

You will save $150 by the end of this challenge, which makes it perfect for smaller budgets, or if you need to save money quickly.

No Spend Challenge

The no-spend challenge is a little different than the money saving challenges, this one requires you to not spend any money beyond your monthly necessities.

For bonus points, you can put the money you were going to spend on extras into your savings account.

If you want to connect with other people who are trying no spend challenges, check out the #nospend and #nospendchallenge hashtags on Instagram.

No Eating Out Challenge

If you’re some kind of crazy masoch*st, you can try not eating out for one whole month.

Let’s have a moment of silence for all the french fry orders that won’t happen. 🍟

You can just focus on not eating out, or you can put the money you were planning to spend on eating out into your savings.

Ready to start saving?

If you’re ready to jump into a savings challenge, pick one of the savings challenges in this article (may I suggest the traditional 52-week saving challenge?), then create a separate savings account for the challenge (CIT Bank is a great choice!) to prepare!

If you want to make it more fun, you can grab an accountability partner and do the savings challenge with them! You can keep each other motivated and share tips about how you’re sticking with the challenge.

Good luck!

FAQs About Saving Challenges

How much money do you save in the 52 week challenge?

It depends on what specific challenge you’re doing, but with the traditional 52 week money saving challenge you will save $1,378 in 52 weeks.

What is the $5 challenge?

The $5 challenge is where you save every $5 bill that you receive.

Insights, advice, suggestions, feedback and comments from experts

As an expert and enthusiast, I have access to a vast amount of information and can provide insights on various topics, including money-saving challenges. I can help you understand the concepts mentioned in this article. Let's dive in!

Money Saving Challenges

Money-saving challenges can be a great way to develop a habit of saving money and stay motivated. They offer a structured approach to gradually increase your savings over time. Here are some key concepts related to money-saving challenges discussed in the article:

-

Benefits of Money Saving Challenges: Money-saving challenges can be fun, motivating, and flexible. They provide a sense of accomplishment as you see yourself getting closer to your savings goal each week. Challenges can be customized to fit your specific budget and goals [[1]].

-

Selecting a Saving Method: Before starting a money-saving challenge, it's important to decide on a saving method that works for you. If you prefer using physical cash, you can use the Cash Envelope method and save money in special envelopes. If you prefer digital banking, you can create a separate savings account for the challenge [[2]].

-

Traditional 52-Week Money Saving Challenge: The traditional 52-week money-saving challenge is a popular one. It involves saving a specific amount of money each week for 52 weeks. The first week, you save $1, and then you increase the amount by $1 each week. By the end of the challenge, you will have saved $1,378 [[3]].

-

Reverse 52-Week Money Saving Challenge: The reverse 52-week money-saving challenge is a variation of the traditional challenge. Instead of saving increasing amounts each week, you save decreasing amounts. You start by saving a higher amount and decrease it by $1 each week until you reach $1 [[4]].

-

Double 52-Week Money Saving Challenge: The double 52-week money-saving challenge is for those who want to save more than the traditional challenge. In this challenge, you save double the amount each week. For example, you start with $2 in week one, then save $4 in week two, and so on. By the end of the challenge, you will have saved $2,756 [[5]].

-

Other Year-Long Money Saving Challenges: The article also mentions a few other year-long money-saving challenges:

- Penny Saving Challenge: This challenge involves saving one penny on the first day and adding a penny to the amount saved each day. By day 365, you will have saved $3.65, resulting in a total of $667.95 saved [[6]].

- $5 Money Saving Challenge: In this challenge, you save every $5 bill you receive. This can be from gifts or change. By the end of the challenge, you will have saved a significant amount depending on how long you continue the challenge [[7]].

- $5,000 Saving Challenge: This challenge aims to save $5,000 in one year. The savings increase gradually over the weeks, starting with $50 and increasing by $25 every few weeks [[8]].

- $10,000 Saving Challenge: For those looking for a bigger challenge, this one aims to save $10,000 in one year. The savings increase over the weeks, starting with $100 and increasing by $50 every few weeks [[9]].

-

Other Money Saving Challenges: The article also mentions a few monthly challenges:

- $5 A Day Saving Challenge: In this challenge, you save $5 every day for one month, resulting in a total of $150 saved [[10]].

- No Spend Challenge: The no-spend challenge involves not spending money on anything beyond your monthly necessities. The money you would have spent on extras can be put into your savings account [[11]].

- No Eating Out Challenge: This challenge requires not eating out for a whole month. The money you would have spent on eating out can be saved [[12]].

Remember, money-saving challenges can be a fun and effective way to develop a savings habit. Choose a challenge that suits your goals and financial situation. Good luck!

Let me know if there's anything else I can assist you with!